November 14, 2018

INTRODUCTION

Albert Einstein once said “the hardest thing to understand in the world is the income tax.” I believe that most everyone would agree with that statement, including our elected officials in Washington. When Congress began the process of developing significant tax legislation in 2017, the terms “simplify” and “reform” were often used so it seemed reasonable to assume that the resulting legislation would, at the very least, make some aspects of the tax law easier. After all, taxpayers were supposed to file their tax returns using a postcard!

After much politicking last year, Congress passed the Tax Cuts and Jobs Act (TCJA) in December 2017. While some might argue that the new law represents a level of reform, it was immediately clear to every tax expert that it is anything but simple. Congress does not appear to have simplified taxes; instead, they have passed legislation that ensures tax accountants will be busy for years to come interpreting and applying the changes.

In the end, the TCJA’s primary goal, as stated in its name, was to reduce taxes. While the largest portion of the tax savings will accrue to large corporations and business owners, many taxpayers at all income levels will see reduced taxes. However, some taxpayers will actually see increased taxes depending on their particular facts and circumstances. Regardless, the new tax laws will be a challenge to apply for many taxpayers.

A few highlights of the TCJA include the following:

- 21% corporate income tax rate;

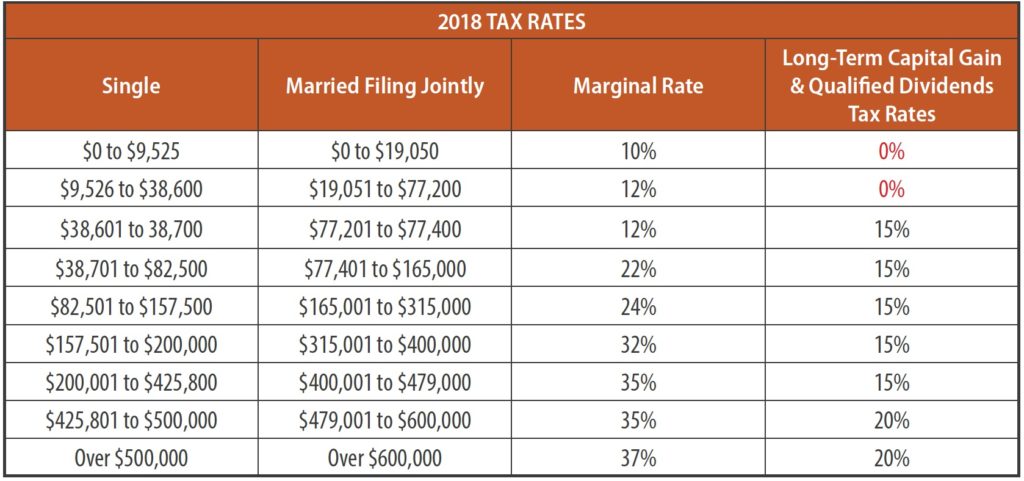

- Lower marginal personal income tax rates;

- 20% deduction for business owners of qualifying pass-through entities and sole proprietors;

- Adjustments to the Alternative Minimum Tax (AMT);

- Increase in the standard deduction;

- Suspension of the personal exemption and increase to the child tax credit;

- Changes to itemized deductions, including limits on the real estate tax, state income tax, and mortgage interest deductions;

- Suspension of deductions for moving expenses, personal casualty and theft losses, and miscellaneous itemized deductions which include unreimbursed employee business expenses, investment expenses, union dues, tax preparation fees, etc.;

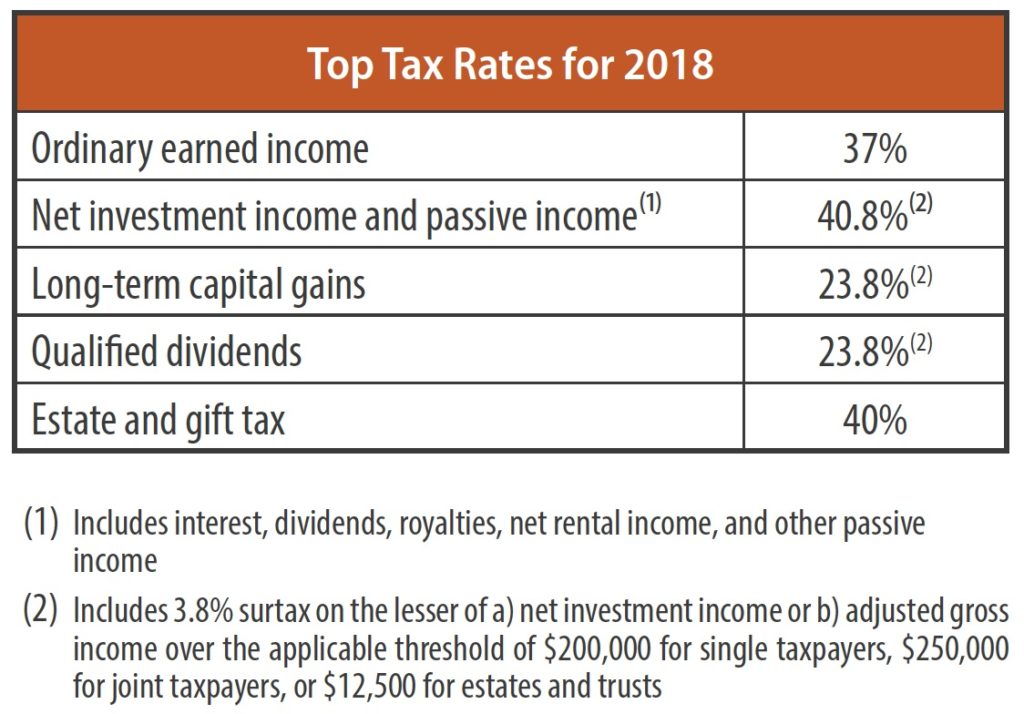

- Increase to the lifetime exemption for gift and estate tax;

- Repeal of the Domestic Production Activities Deduction;

- Limitation on the deductibility of business interest for certain large businesses;

- New limitations on the ability to deduct “excess business losses” from pass-through entities;

- Modifications on the utilization of net operating losses.

To ensure that you are able to maximize the benefits created under the TCJA, it’s important to review the annual Blume Keeney Tax Planning Guide. Some planning opportunities remain the same, while new opportunities have been added. Your particular situation changes from year to year so it is important to read through the guide and identify any areas that might apply. Give Jenny or Ryan a call so that we can personally talk with you about opportunities the TCJA created for you.

TAX PLANNING CHECKLIST FOR INDIVIDUALS

Income Planning

- Tax-Exempt Income – Review investment portfolios to consider exposure to municipal bonds. Not only is the interest tax-exempt, it’s also not subject to the 3.8% Net Investment Income Tax (NIIT) that might apply to other taxable income.

- 0% Tax Rate Income – For some taxpayers in the 10% or 12% income tax brackets, long-term capital gains and qualified dividend income is taxed at 0%. So if you are in one of these tax brackets, consider capital gain harvesting before year-end to increase basis within a portfolio. Note that wash sale rules that limit capital losses do not apply to gains.

- Suspended Passive Losses – Review your passive loss carryovers if selling real estate or business interests. Losses from a passive activity that are not allowed to offset current income due to the passive loss rules are suspended and carried forward. Disposing of a passive activity with suspended losses allows the current year losses and suspended losses to offset income.

- Income Deferral – When possible, recognize income after year-end. For example, defer bonuses or delay stock option exercises and asset sales, or utilize installment sales when possible.

- Passive Income – Explore ways to increase the level of participation with passive entities or rental properties to avoid the additional NIIT. Income from passive activities may be subject to the NIIT 3.8% surtax in addition to income tax. However, this can be mitigated if taxpayers can meet one of the tests for material participation.

- IRA Conversion Strategy – Evaluate your IRA and anticipated income level for 2018 to determine if a portion of your IRA should be converted to a Roth IRA. This conversion will create additional taxable income in the current year, at a potentially lower tax rate, but the distributions from the converted account will be income tax free in future years.

- Age 70.5 Initial Required Minimum Distribution – If you turn age 70.5 during 2018, you have until April 1, 2019 to take your initial required minimum distribution (RMD) from retirement plans. However, if you do wait until 2019 to take your initial distribution, you will then have a double distribution in the same year potentially causing negative tax implications. To avoid that, consider taking your age 70.5 RMD prior to year-end.

- Like-Kind Exchange – Consider using a like-kind exchange on the sale of rental or business property to defer taxable gains.

- Long-Term Capital Gains and Qualified Dividends – Review investment portfolios to take advantage of the preferential income tax rate for long-term capital gains and qualified dividends.

- Child’s Income – Transfer income producing assets, or appreciated property to kids to utilize their (generally) lower tax bracket. However, the Kiddie Tax could eliminate a majority of the tax savings if the child is under age 18, or under age 24 and a full time student.

- Same-Sex Marriage – Guidance relating to same-sex marriage has changed tax return filing requirements for certain individuals and created opportunities to potentially reduce income taxes. Furthermore, these changes apply retroactively so it is important to consider prior year tax returns in light of these changes.

- Capital Loss Harvesting – Market appreciation during the year may have generated realized capital gains. Review your portfolio to utilize any unrealized capital losses (when appropriate) to mitigate capital gains. Capital losses can be used to offset capital gains, and unused losses are carried forward to offset future capital gains. However, the wash sale rules impact the benefit if the same asset is reacquired within a specified time period.

- Incentive Stock Options (ISO) – Due to the changes with AMT resulting in an increased AMT income threshold, evaluate ISO exercise strategies and consider exercising ISOs in a qualified transaction.

- Alimony – For divorces and legal separations executed after December 31, 2018, alimony and separate maintenance payments are not deductible by the payor spouse and not included in the income of the payee spouse. Alimony and maintenance payments continue to be deductible by the payor spouse and included in income of the payee spouse for agreements executed before 2019.

- Foreign Bank Accounts – With some exceptions, bank accounts, securities, mutual funds, online poker accounts, or insurance policies with cash value that are physically located outside the U.S. must be disclosed to avoid penalties. This applies to employees with signature authority and foreign retirement accounts.

Deduction Planning

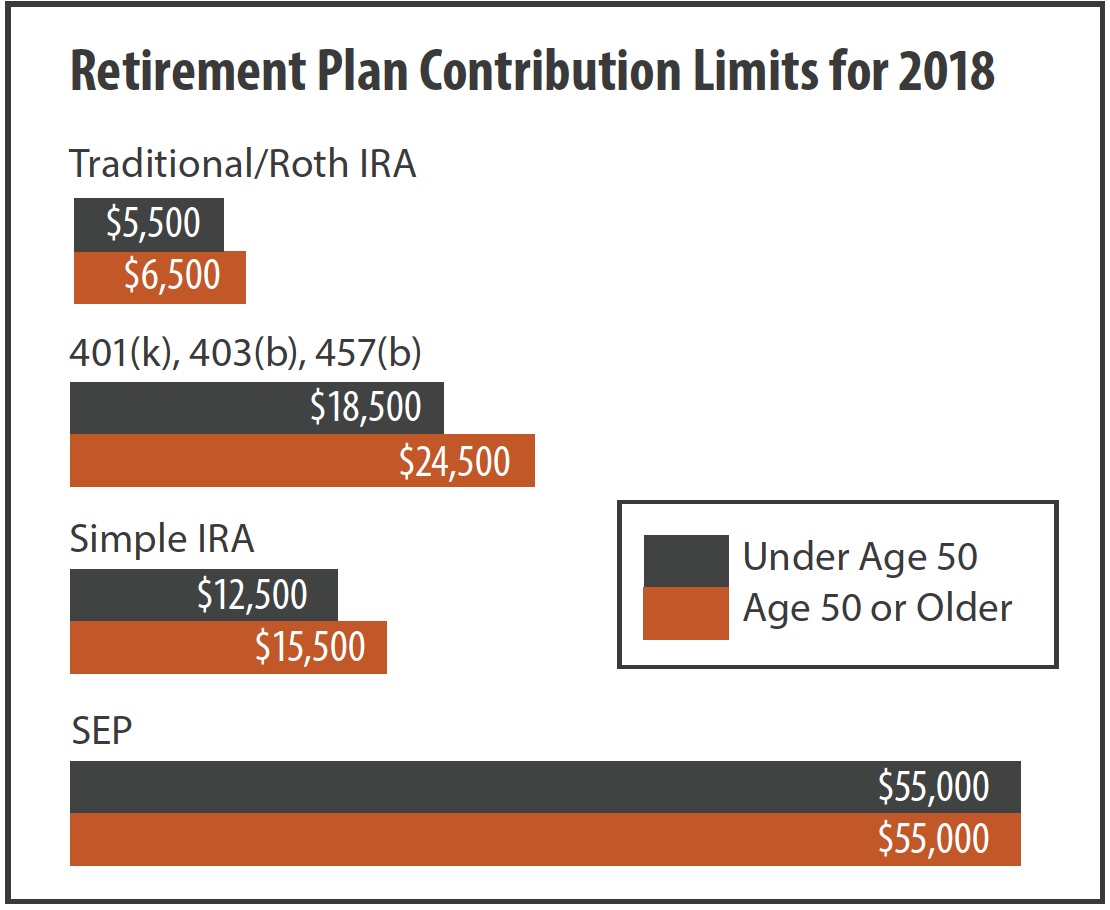

- Retirement Plan Contributions – Certain plans, such as 401(k) and Keogh plans allow larger tax deductions than IRAs or SEP IRAs but they must be established by year-end.

- Over Age 50 Retirement Plan Contributions – If over age 50, be sure to utilize the “catch-up contribution” that allows for an additional $6,000 contribution to a 401(k) and a $1,000 contribution to an IRA in addition to the regular contribution limits.

- Health Savings Account (HSA) Contributions – If eligible, contributions to an HSA are tax deductible and eligible distributions are tax-free.

- Bunch Deductions – With the new increased standard deduction making it harder to reach the threshold to itemize deductions, consider bunching two years of deductions into one year by accelerating or deferring deductions like medical expenses, mortgage interest, and charitable contributions to maximize the deduction benefit.

- Charitable Contributions – Consider giving appreciated property to a charity instead of cash to receive a deduction for the fair market value and avoid paying tax on the capital gain. Conversely, depreciated investment assets should be sold first, and the cash donated to charity to receive the benefit of the capital loss.

- Timing of Charitable Contributions – Credit card charges and checks mailed on or before December 31, though not actually paid until 2019, are still considered deductions in 2018.

- Charitable Miles – A deduction of $0.14 per mile is allowed when using a vehicle for charitable purposes, plus parking fees and tolls.

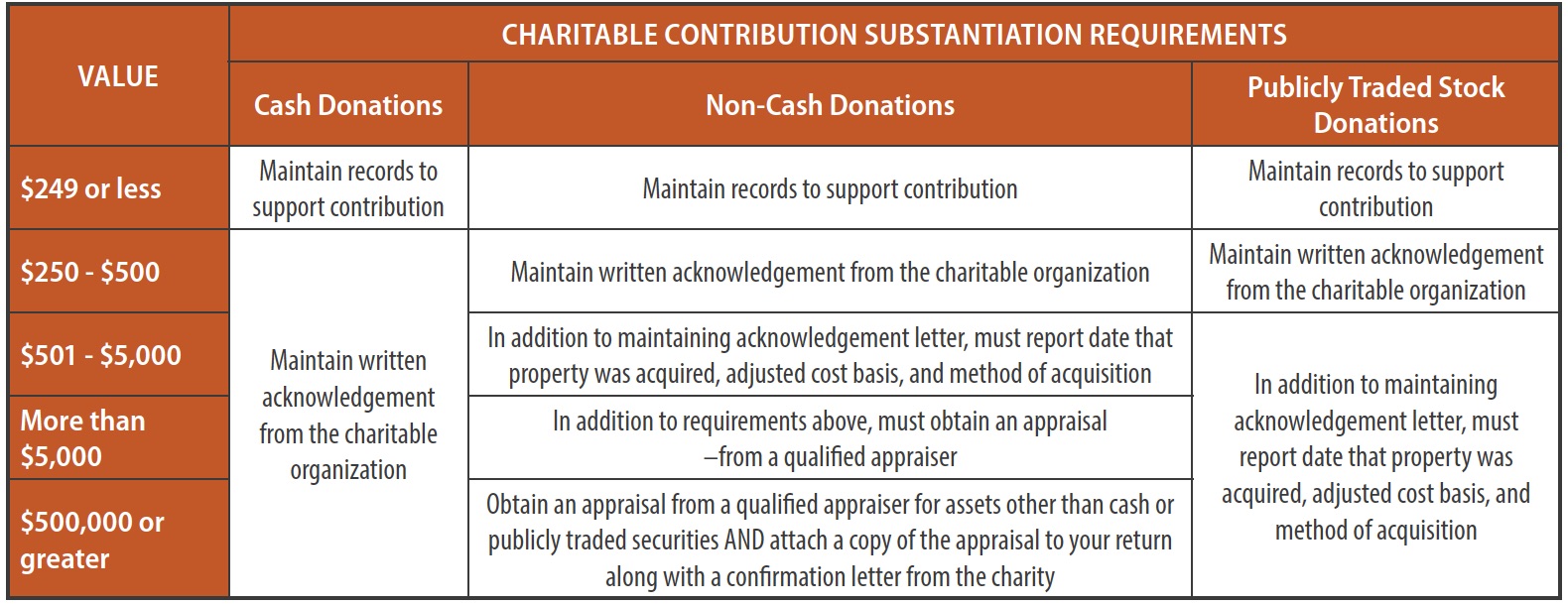

- Substantiation of Charitable Contributions – The IRS has been disallowing charitable contribution deductions when taxpayers are unable to completely meet the substantiation requirements. When giving over $250 to charity, be sure to get an acknowledgement letter from the charity. It would even be advisable to take a photo of non-cash items contributed.

- Qualified Charitable Distribution (QCD) – If over age 70.5, you can make tax-free distributions from your IRA of up to $100,000 directly to charitable organizations. These distributions are excluded from your taxable income. The QCD also provides benefit from the contribution even if the taxpayer is utilizing the standard deduction.

- Home Equity Interest – For tax years 2018 through 2025, the deduction for interest from a home equity loan or line of credit is suspended if the proceeds were not used to acquire or substantially improve your primary or secondary home. The loss of deduction should be factored into the total financing cost for the purchase, and consider reducing the outstanding debt.

- Education Credits and Deductions – To be eligible for the American opportunity tax credit or the lifetime learning credit, taxpayers must have a Form 1098-T from the educational institution. Information from the Form 1098-T is needed to claim the credits or deductions.

- Mortgage Interest – Interest from mortgage loans originating after December 15, 2017 is deductible on mortgage debt up to $750,000. Loans originating before that date are still able to use the same $1 million limitation. Second mortgages are also deductible as long as the proceeds were used to acquire or improve the residence and the total mortgage debt is below the applicable threshold.

- College Athletic Seating Rights – Charitable contribution deductions for college athletic seating rights are no longer deductible beginning in 2018.

- Residential Energy Tax Credits – The tax credits for installing residential energy efficient property and personal energy property were reinstated for 2018 through 2021. This includes an unlimited 30% credit for installing solar water heaters, solar panels, geothermal heat pumps, small wind turbines, and fuel cells; along with a limited 10% credit for items meeting specific energy efficiency requirements, including biomass stoves, central air conditioners, furnaces, insulation, roofs, hot water heaters, windows, doors, and skylights.

- School Teachers – Elementary and secondary school teachers are allowed to deduct up to $250 on books, supplies, and materials purchased for their classrooms.

Estate and Gift Planning

- Annual Exclusion – Every taxpayer has a $15,000 per recipient annual exclusion from gift tax. Combined with a spouse’s annual exclusion, a married couple can give $30,000 per recipient. Consider evaluating your gifting options before year-end.

- State Estate Tax – Some states, including Washington, Oregon, and Massachusetts, have state estate taxes. The state exemptions are lower than the federal exemption so it is important to consider state estate taxes in your estate plans.

- Charitable Gifts – Taxpayers with significant charitable intent may be able to receive both an income tax benefit and an estate tax benefit with proper planning.

- Interest Rates – Applicable federal rates (AFRs), minimum interest rates that are required to be charged by related parties, have been increasing, but still remain relatively low. In some cases, it may be possible to refinance loans between related parties to reduce interest payments.

- Federal Lifetime Exemption – The federal lifetime exemptions for gift and estate tax is now $11.18 million (this is in addition to the $15,000 per-recipient annual exclusions for lifetime gifts referenced above). The gift and estate tax rate for transfers greater than $11.18 million is 40% for 2018.

- Valuation Discounts – Discounts have been an extremely valuable tool in the estate planning arena for decades. Proposed regulations from Treasury to limit the application of these discounts have been withdrawn so this strategy is still available.

- Same-Sex Marriage – New guidance relating to same-sex marriage has created opportunities for certain individuals. Wills and other estate planning documents should be updated to incorporate these new opportunities.

Affordable Care Act – Health Insurance

- Required Insurance – All U.S. citizens and legal residents are required to have qualifying health insurance. There are some exemptions, primarily due to financial hardship or short-term gaps in coverage.

- Penalties – The penalty for not obtaining qualifying health coverage is $695 per adult ($347.50 per child) or 2.5% of household income in 2018. The TCJA reduced the penalty to $0 starting in 2019.

- Premium Tax Credits – Taxpayers with household incomes below four times the federal poverty limit ($48,560 for an individual, $100,400 for a family of four) may qualify for a premium tax credit or a premium subsidy.

- Reporting – A Form 1095-A, 1095-B, or 1095-C will be issued to anyone enrolled in health insurance during the year substantiating health insurance coverage for the calendar year. These forms will be needed to complete the Form 1040.

TAX PLANNING CHECKLIST FOR TRUSTS

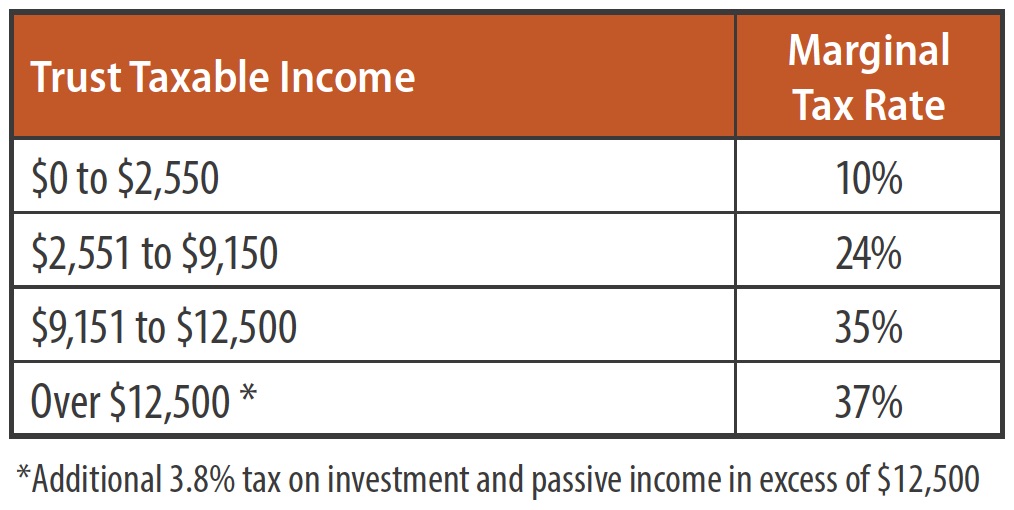

- Distributions – Trusts have a low threshold of $12,500 for the NIIT so most undistributed income in a trust will be subject to the additional tax. Trustees should consider maximizing distributions to beneficiaries, and consider strategies to distribute capital gains.

- Passive Activities – IRS guidance has clarified the application of NIIT on a trust’s business and/or real estate income. In light of this new guidance, consider the role of a trustee in the management of the trust assets and whether additional steps can be taken to mitigate this additional tax.

- Income Sources – Similar to the tax planning strategies for individuals, trustees should evaluate the role of tax-exempt income in the trust’s investment portfolio given the 3.8% NIIT on taxable income.

TAX PLANNING CHECKLIST FOR BUSINESSES

- Entity Selection – With the new corporate tax rates, consider evaluating the tax benefits of a C corporation compared to an S corporation.

- 20% Qualified Business Income Deduction – Non-corporate taxpayers with income from a pass-through entity or sole proprietorship are allowed a deduction of up to 20% of the qualified business income (QBI). Certain service businesses are excluded, but some rental activities are included.

- Form W-2 – The filing deadline for Forms W-2/W-3 is January 31. Employers are also required to disclose the annual cost of health plan or HRA coverage to an employee on the W-2.

- Health Insurance – Employers with 50 or more FTE employees must offer minimum essential coverage and report insurance coverage for employees on Forms 1094-B, 1094-C, 1095-B, and 1095-C.

- Cash Method of Accounting and UNICAP – Under the TCJA, taxpayers that satisfy a $25 million gross receipts test may now use the cash method of accounting and are exempt from application of the uniform capitalization (UNICAP) rules.

- Limitation on Health FSA Reimbursements – The maximum Health FSA reimbursement may not exceed $2,650 per year for 2018.

- Buy-Sell Agreements – Buy-Sell Agreements can act as a will for businesses. Agreements should be reviewed and updated regularly. This is especially important in any business with multiple owners.

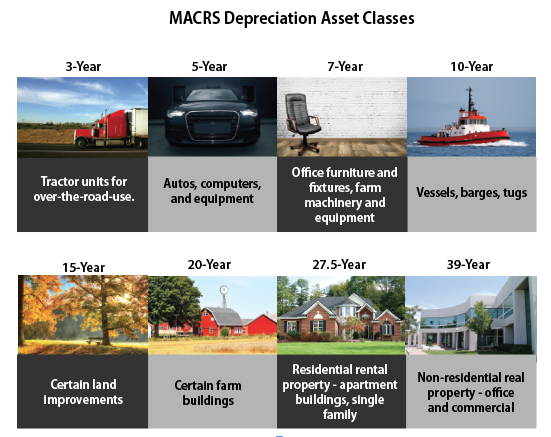

- Section 179 – The Section 179 depreciation deduction for qualifying assets acquired in 2018 is $1 million. This depreciation deduction begins to phase out once total depreciable assets purchased during the year exceed $2,500,000. The definition of qualifying assets has also been expanded to include roofs, heating systems, HVAC units and other specific assets that are used in a trade or business.

- Bonus Depreciation – 100% bonus depreciation is allowed for qualified tangible personal property with a recovery period of 20 years or less, for both new and used assets.

- Entertainment and Fringe Benefits – The 50% deduction for business-related entertainment expenses and deduction for employee transportation fringe benefits are now disallowed. The 50% deduction for business meals is still allowed.

- Family Employees – Consider hiring your school-age child to work for your business part-time. Reasonable compensation is deductible, reducing your self-employment income. No Social Security or Medicare tax is due on the child’s earnings if they are under age 18 and the business is not a corporation. Also, the child could make a contribution to a traditional or Roth IRA.

- Form 1099 – Any non-corporate vendor paid over $600 must be issued a Form 1099 to report payments. The Form 1099/1096 is due by January 31 and the penalty for late filing can be as high as $530 per Form 1099 with no maximum penalty. The IRS has emphasized greater enforcement of the Form 1099 compliance process.

- Small Business Health Care Tax Credit for Small Employers – Small employers, generally those with fewer than 25 full-time equivalent employees with average wages of $50,000 or less, are allowed a maximum credit for 50 percent of premiums paid for employees health insurance. Insurance must be purchased through the Small Business Health Options Program (SHOP) or qualify for an exception to the requirement.

- Health Reimbursement Arrangement (HRA) – Employers with fewer than 50 employees and no company provided health insurance can utilize an HRA to reimburse employees for healthcare expenditures. Annual reimbursements are limited to $5,050 for employee only coverage and $10,250 for family coverage.

- Work Opportunity Tax Credit – Employers who hire and retain veterans and other qualified individuals, including long-term unemployment recipients, are eligible for a tax credit up to 40% of the employee’s wages.

- Employer-Provided Child Care Credit – Employers can claim a credit of 10 to 25 percent up to $150,000 for supporting employee child care or child care resource and referral services.

- Research and Development Credit – Companies that develop new or improved products or processes may be able to benefit from research tax credit incentives. The research tax credit law was permanently extended.

- Qualified Small Business Stock (Section 1202) – Sec. 1202 stock provides an exclusion of gain from certain small business stock sales in C corporations. The exclusion can be as high as 100% of the gain.

- Family and Medical Leave Credit – Employers that provide paid family and medical leave to qualified employees during 2018 and 2019 are eligible for a new credit of 25% of wages paid for up to 12 weeks of pay.

IMPORTANT TAX DUE DATES

For Businesses, Individuals, and Trusts

For most taxpayers the TCJA has increased the complexity of income tax planning and tax return filings. However, those same complications present a number of planning opportunities available to you for 2018 and beyond. We are always happy to discuss these opportunities with you.

Contact Jenny Keeney or Ryan Blume for more information.

(425) 404-3540

Jenny Keeney, CPA, MPAcc

Partner

(425) 404-3544

jenny@blumekeeney.wpmudev.host

Ryan Blume, CPA, CFP®

Partner

(425) 404-3545

ryan@blumekeeney.wpmudev.host

Any tax advice contained in this communication, unless expressly stated otherwise, was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties that may be imposed on the taxpayer under the Internal Revenue Code or applicable state or local tax law or (ii) promoting, marketing, or recommending to another party any tax-related matters addressed herein.